August 7, 2023

Earning money from property outside the U.S.? Here’s a simple guide to help you understand the tax stuff.

Taxes in the Property’s Country:

If you’re getting rent from a property in another country, that country might ask you to pay tax. Every country has its own rules. Some may ask for tax yearly, while others take a bit from the rent you collect. It’s smart to get advice from a local tax expert in that country.

U.S. Tax Rules:

On top of the foreign tax, you also need to let the IRS know about the money you made abroad. So, you add the overseas rent you earned to your U.S. tax forms.

Avoiding Paying Tax Twice:

Nobody wants to pay tax two times on the same cash! The U.S. has ways to help. There’s something called a “foreign tax credit”. It means if you’ve paid tax in another country, you can reduce your U.S. tax by that amount. It’s a way to balance things out.

Special Reports for Overseas Assets:

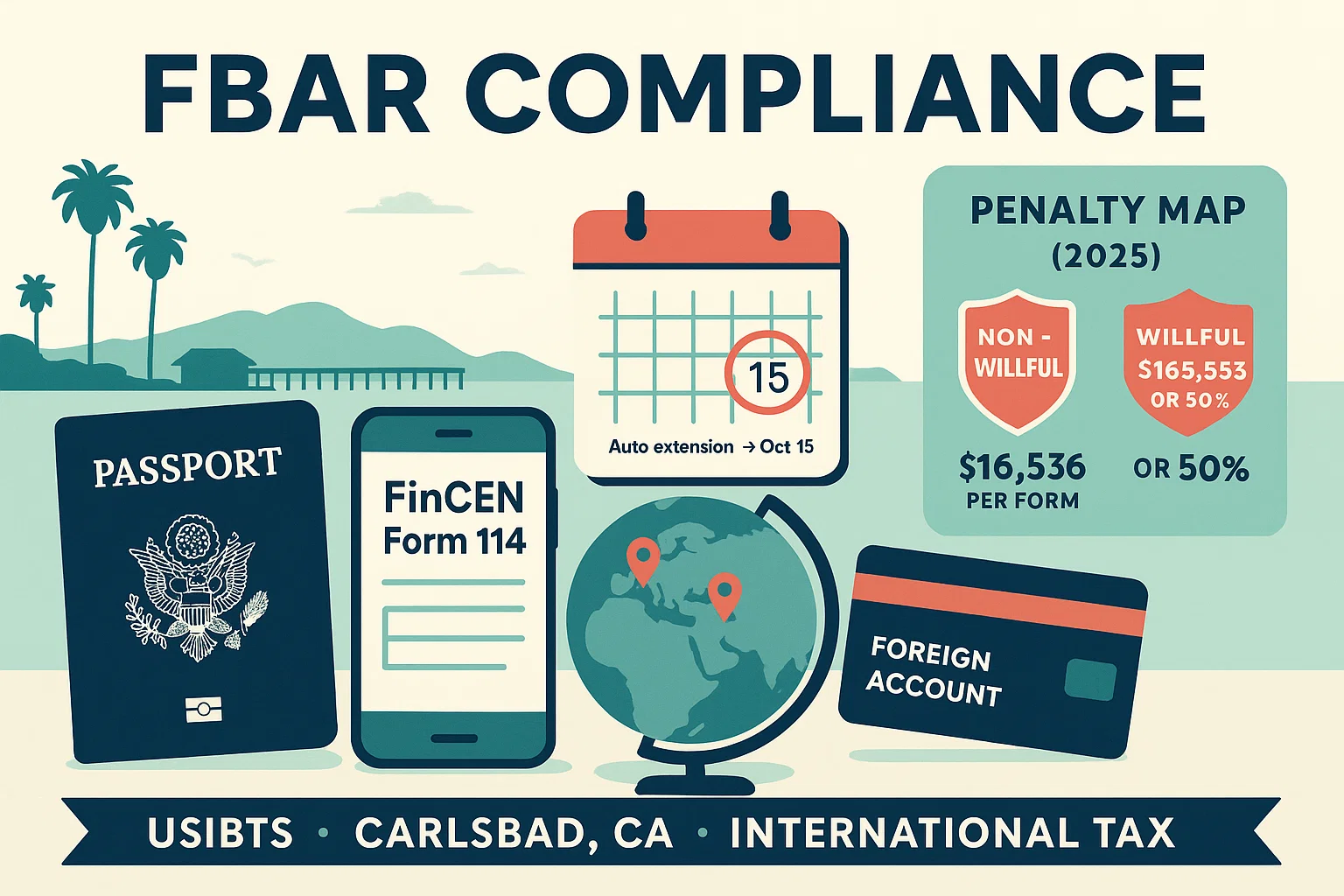

U.S. laws like FATCA (Foreign Account Tax Compliance Act) and FBAR (Report of Foreign Bank and Financial Accounts) require U.S. citizens to report foreign financial accounts and assets. If your foreign property earns or costs a certain amount, or if you have foreign bank accounts with enough money in them, you need to report them. Not doing so can lead to penalties.

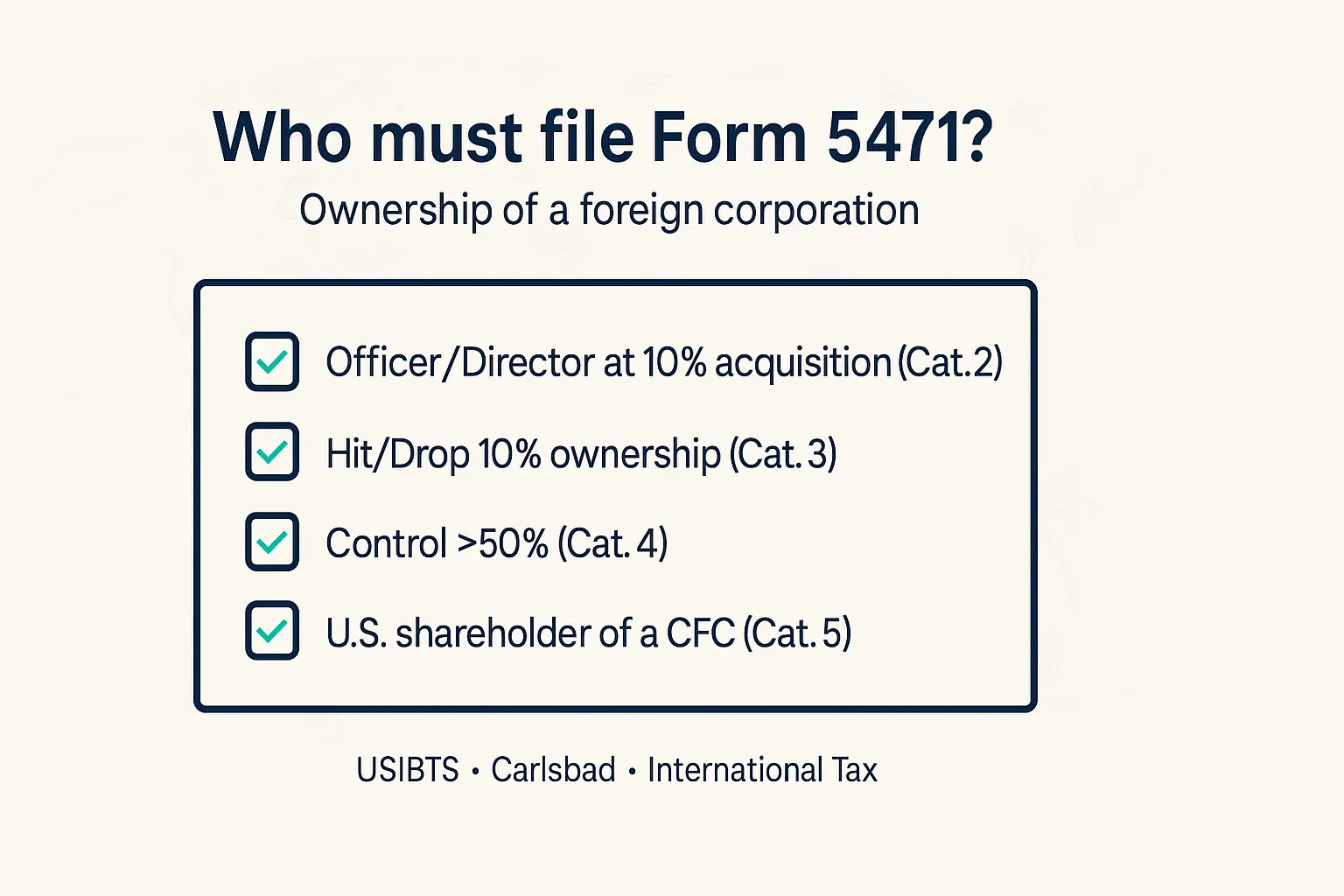

If your property is run by specific foreign businesses, there’s another form, “Form 8858”, you need to fill. Be careful; if you miss it or fill it wrong, you might have to pay a fine.

Having property overseas can be great for making money, but it’s important to understand the tax side of things. Always remember, this is just a basic guide. It’s always good to talk to a tax expert for help with your own situation.

Share this post :

Categories

Latest Post